Beware of the Rise in “Scamscriptions” and Recurring Payment Traps: Insights from Ethical Marketing News

In today's digital landscape, consumers are facing a growing concern with the prevalence of "scamscriptions" and recurring payment traps. According to recent data from November 2023, there has been a notable surge in unexpected recurring payments from companies that individuals did not recognize in their bank statements. This concerning trend has been highlighted by Ethical Marketing News, which has been receiving complaints about unwanted recurring payments dominating the scam reports.

Understanding Scamscriptions and Recurring Payment Traps

Scamscriptions refer to deceptive subscription schemes where individuals are unknowingly signed up for recurring payments without their explicit consent. On the other hand, recurring payment traps are strategies employed by unscrupulous companies to lock consumers into continuous payments without offering clear opt-out options. These traps have become increasingly common, with around a third of survey respondents stating they encountered unexpected recurring charges from unfamiliar companies.

Definition and Types of Scamscriptions

Scamscriptions encompass various forms of fraudulent subscription models designed to deceive consumers into ongoing payments. They can range from misleading free trial offers that transition into costly subscriptions to hidden charges buried in the fine print of online purchases. These tactics aim to capitalize on individuals' oversight, leading to financial losses and customer dissatisfaction.

Common Characteristics of Recurring Payment Traps

Recurring payment traps are characterized by their elusive nature, making it challenging for consumers to identify and halt the continuous charges. Many individuals reported struggling to recognize unauthorized transactions in their bank statements, further exacerbating the problem. The prevalence of these traps has prompted the development of tools like the "scam sharer tool," allowing individuals to share and alert others about suspicious recurring payment practices.

Factors Driving the Increase in Payment Traps

As the incidence of payment traps on the rise, several factors contribute to the proliferation of these deceptive practices, posing a significant threat to consumers and their financial well-being.

Consumer Vulnerability and Behavioral Tactics

Consumer vulnerability plays a crucial role in the success of scamscriptions and recurring payment traps. Unethical companies often exploit consumers' trust, lack of attention to details, and the convenience of online transactions. The psychological tactics employed by these entities, such as creating a sense of urgency or using complex language in terms and conditions, make it easier for consumers to overlook the consequences of signing up for recurring payments.

Regulatory Challenges and Legal Loopholes

Regulatory challenges and legal loopholes also contribute to the increase in payment traps. Inadequate consumer protection laws and enforcement mechanisms create an environment where fraudulent companies can operate with impunity. The intricate nature of online transactions and cross-border payments further complicates the regulatory landscape, making it challenging for authorities to combat these deceptive practices effectively.

Implications for Consumers and Ethical Marketing Practices

As the issue of scamscriptions and recurring payment traps gains traction, it is essential to consider the implications for consumers and ethical marketing practices.

Financial Consequences for Unwary Consumers

Unwary consumers who fall victim to scamscriptions and recurring payment traps may face severe financial consequences. The unexpected charges can quickly add up, leading to financial strain and potential hardships for individuals who did not recognize the companies behind these transactions. This highlights the importance of vigilance and awareness when it comes to monitoring one's banking activities to avoid falling prey to such deceptive practices.

Raising Awareness and Promoting Transparency

Raising awareness about scamscriptions and recurring payment traps is crucial in promoting transparency within the marketplace. Ethical Marketing News' efforts to shed light on unwanted recurring payments dominating scam reports play a vital role in educating consumers about the risks associated with deceptive subscription models. By fostering transparency and encouraging open dialogue about these unethical practices, consumers can make more informed decisions and protect themselves from potential financial harm.

Best Practices to Avoid Scamscriptions and Payment Traps

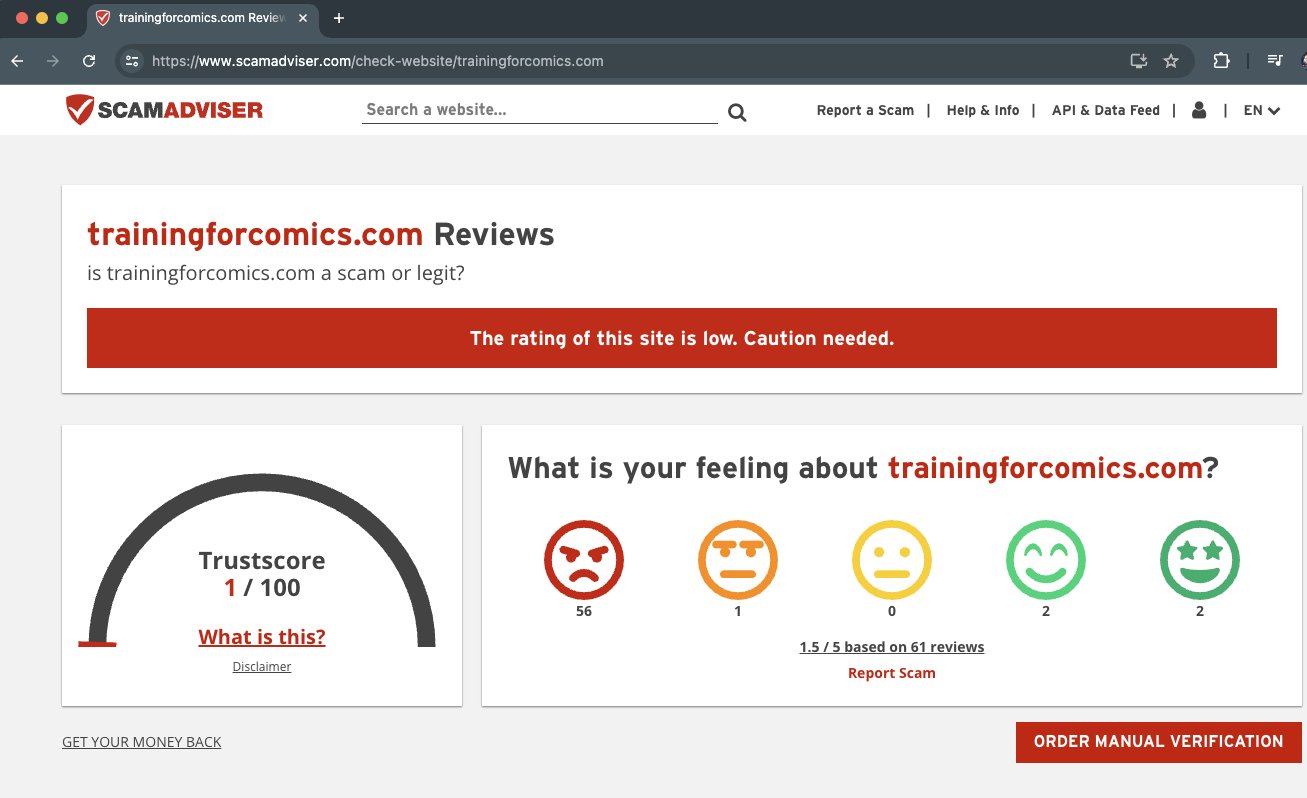

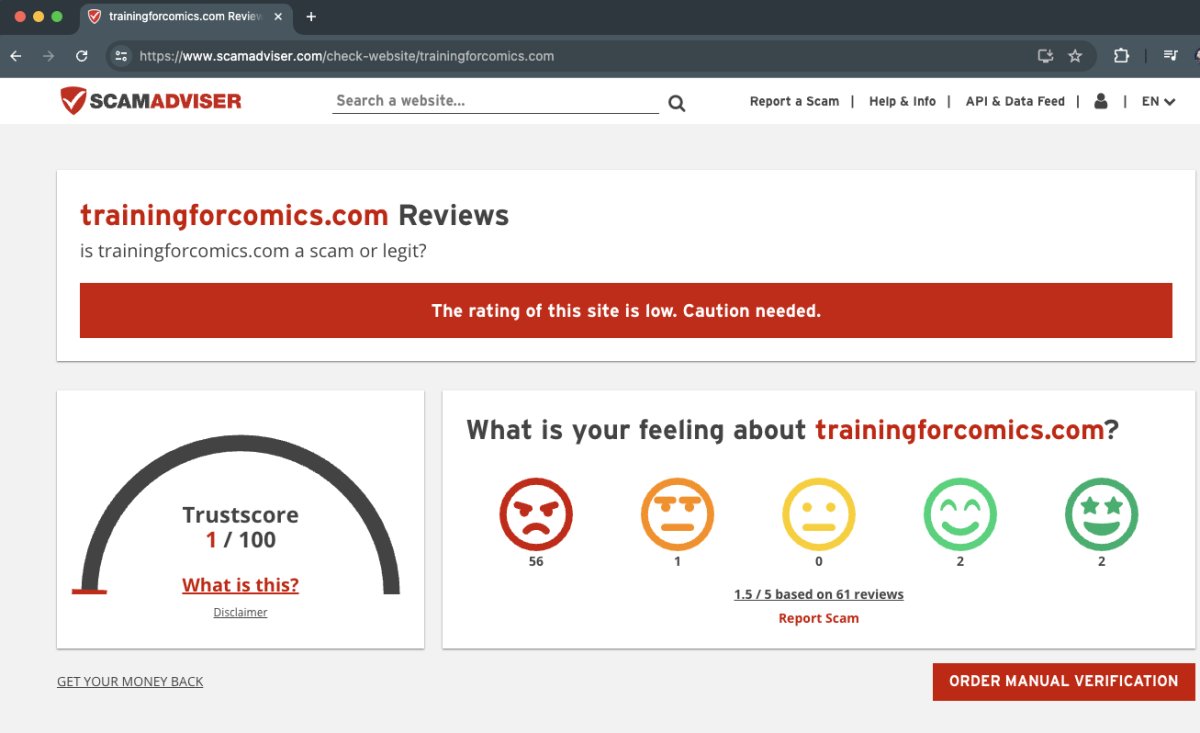

Prior to signing up for any trial, offer or making a payment to a company suing online payment systems, go to the above site, https://scamadviser.com and see how that company has been reviewed and what other are saying.

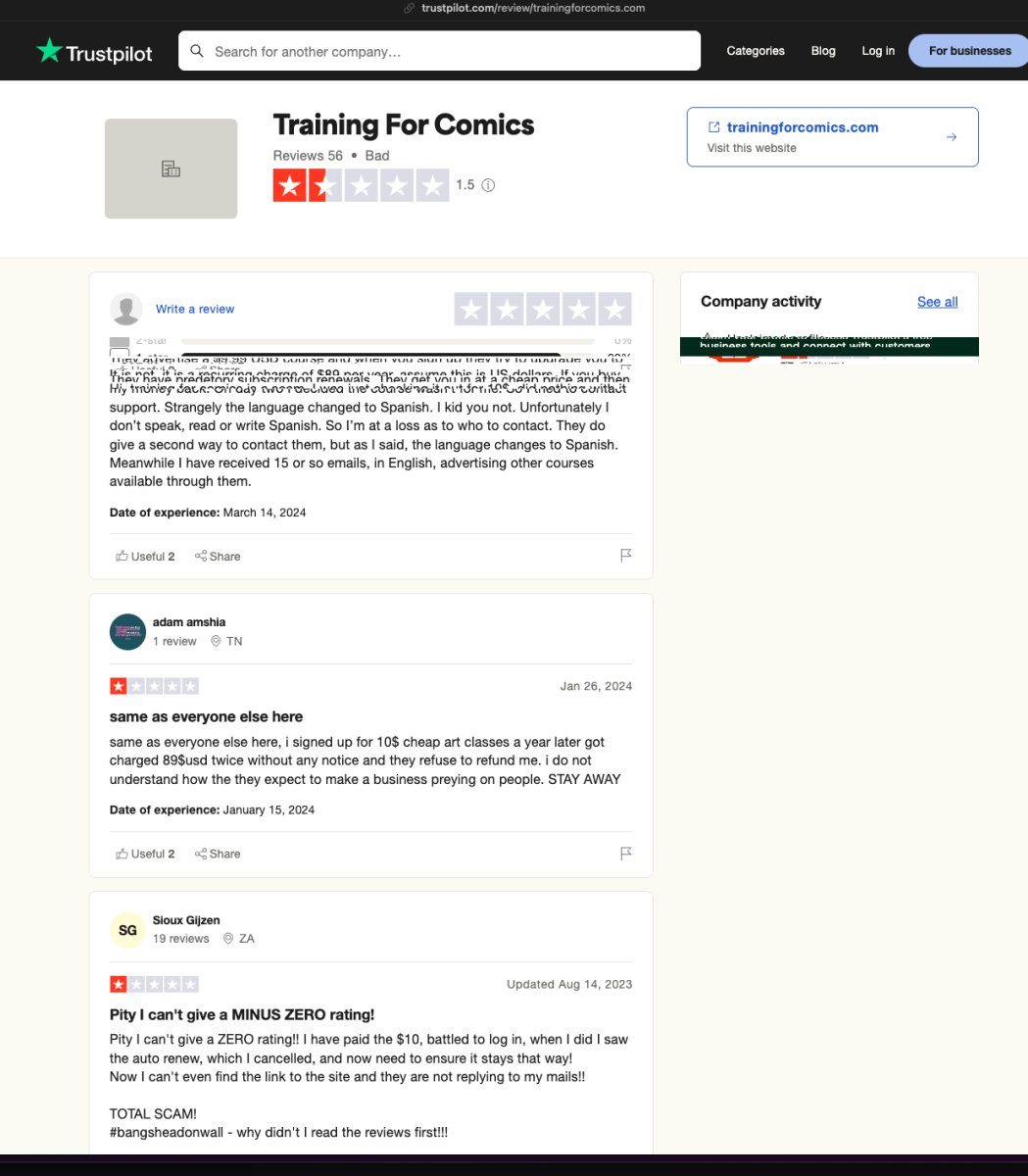

Another site that I use is https://trustpilot.com - many people use this to report scams that they have been hit with.

Tips for Evaluating Subscription Services

When evaluating subscription services, consumers should exercise caution and diligence to avoid falling into scamscription traps. It is advisable to thoroughly review the terms and conditions, especially regarding payment structures and cancellation policies. Additionally, researching the reputation of the company and seeking feedback from other users can provide valuable insights into the reliability and trustworthiness of the service provider, helping consumers make informed choices.

If you are looking at a subscription or trial, take a moment to go to scamadvisor.com and trustpilot.com check to see if the site has any reports for being a scam.

Legal Rights and Recourse for Misleading Practices

Understanding one's legal rights and recourse options is essential in combating misleading practices such as scamscriptions. Consumers have rights protected by consumer protection laws that safeguard them against deceptive marketing tactics. In case of unauthorized recurring payments or fraudulent subscription schemes, individuals should promptly report the issue to relevant authorities and seek legal assistance to seek recourse and potentially recover any losses incurred. By being aware of their rights, consumers can hold companies accountable for unethical behavior and protect themselves from falling victim to payment traps.

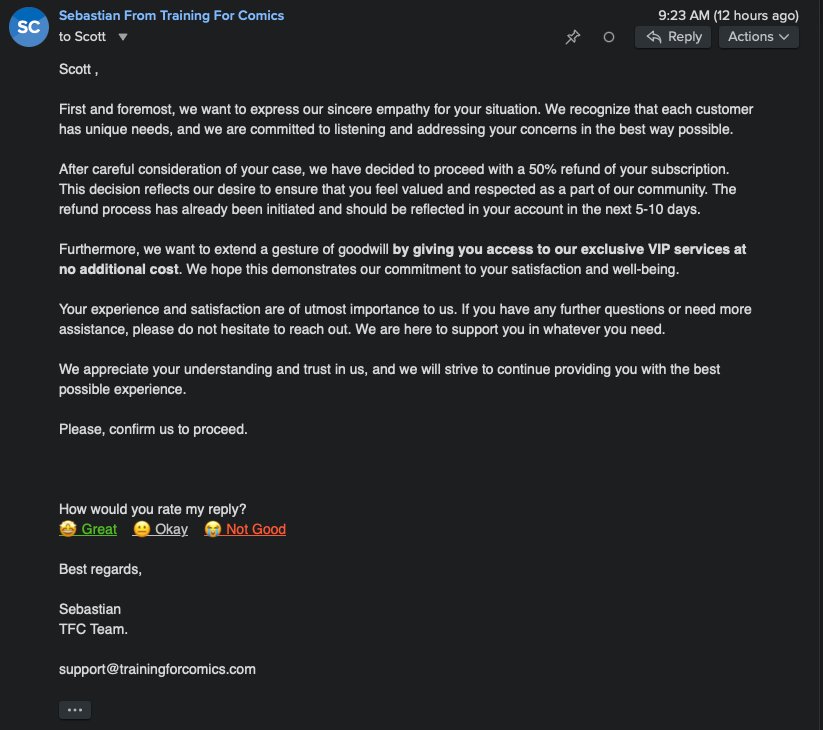

Paying via PayPal used to allow consumers the protection from these scams. All one had to do was let PayPal know that they had not signed up for the subscription.

The scammers have gotten PayPal to dishonor victim's claims by stating that the consumer legitimately signed up and did so according to "terms" on the site. Never mind that that the terms do not exist anywhere on the site or in the initial sign-up for a trial.

Attempting to login to the scam site to close the account does not work either, as these companies have setup websites where there are no options to disable, close, delete or remove the account.

In some cases, you may not even be able to locate the options to disable or cancel the subscription.

Conclusion:

Some ads on social media are there just to get your information such as your phone number, email address and physical address for resale to data brokers. Other's use that to hack accounts with the fact that many passwords are made up of simple things like a location.

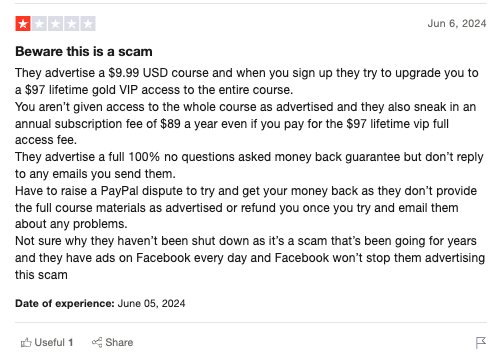

Even a leading guitar lesson company had a hidden subscription that was buried far down in the advertising and only was evident when I had clicked through about four pages of "funnel" junk to get to it.

$5 upfront. Three months later I would have been charged just about $300 for that subscription.

Be very wary of those free trials signups. It may cost you more to get it reversed and you may end up getting the reversal denied as in my case. I had to file with my bank to block any future charges as there is not cancel button on that Trainingforcomics site. Nor is there a way to delete my account.